Join 35,000 other teachers, parents, and librarians who receive my newsletter of children’s book reviews & learning resources.

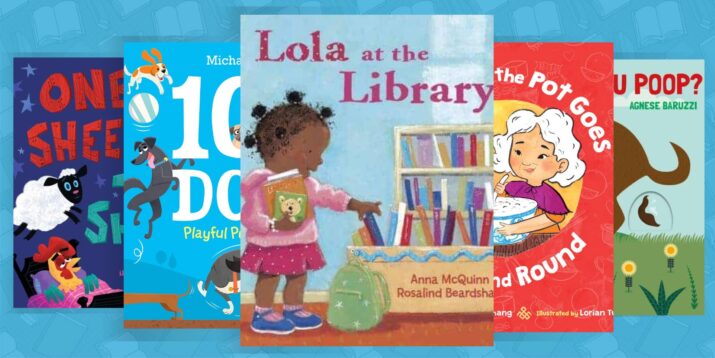

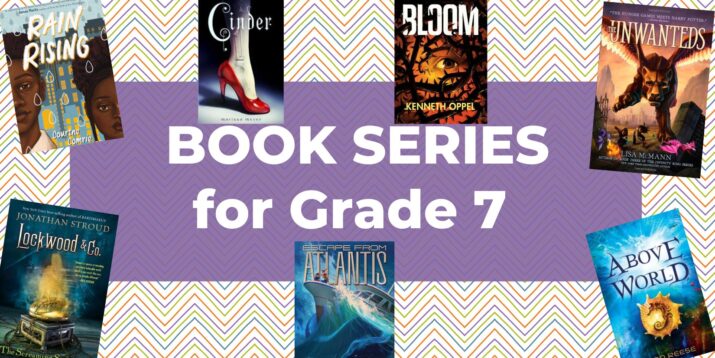

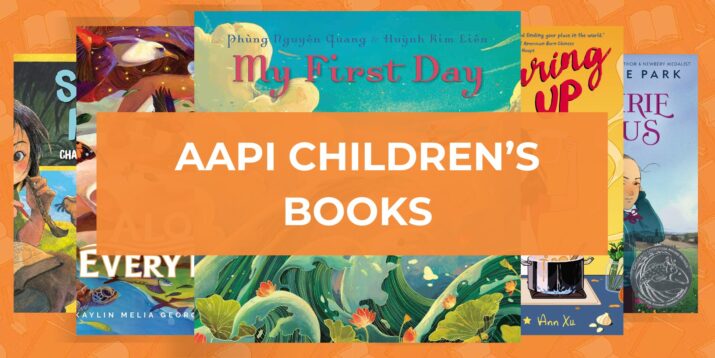

Good Children’s Books for Every Reader

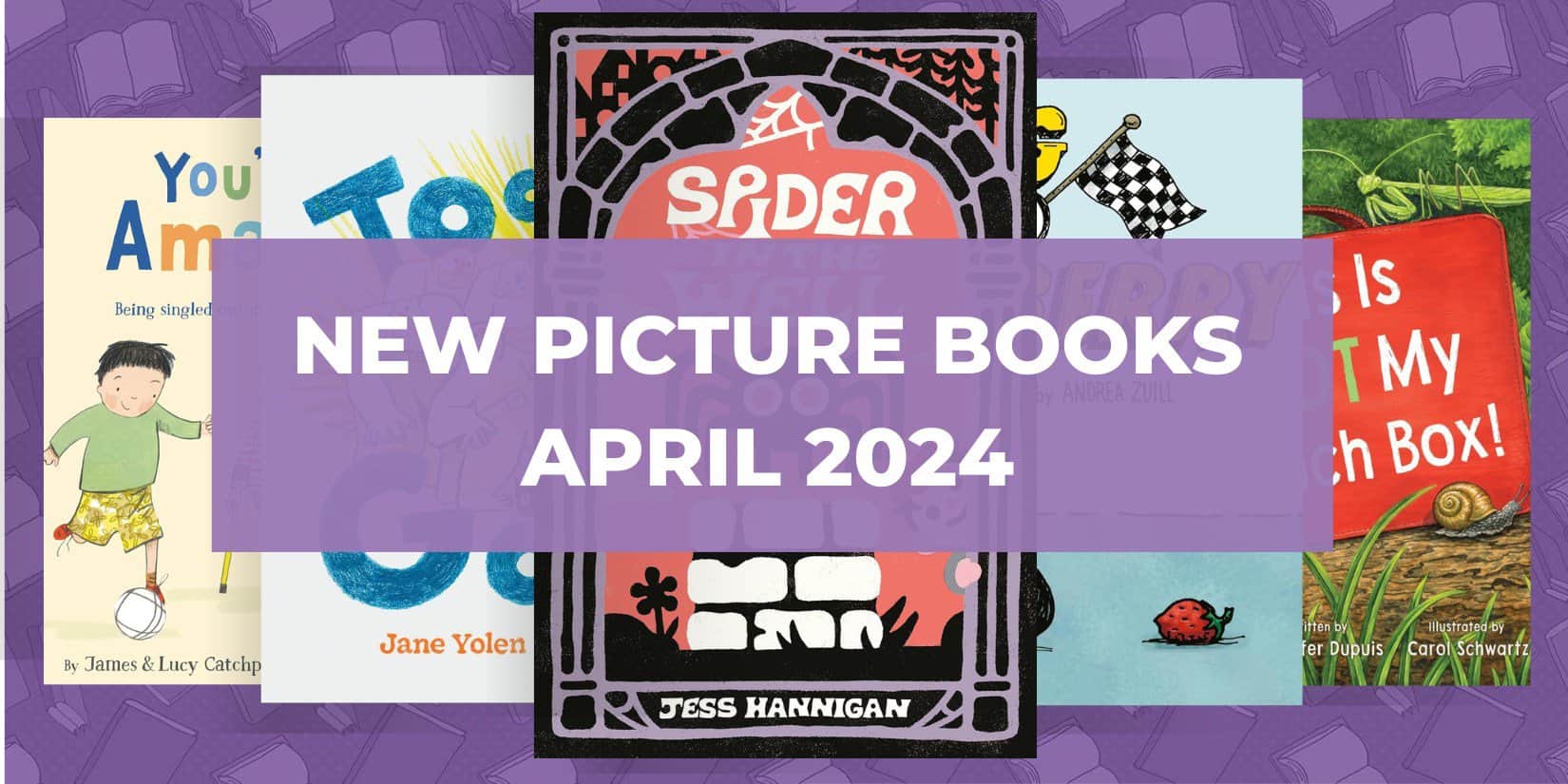

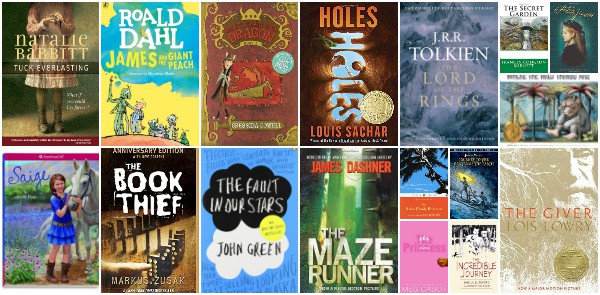

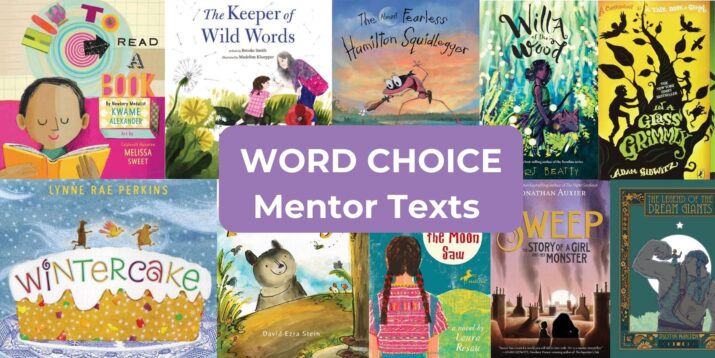

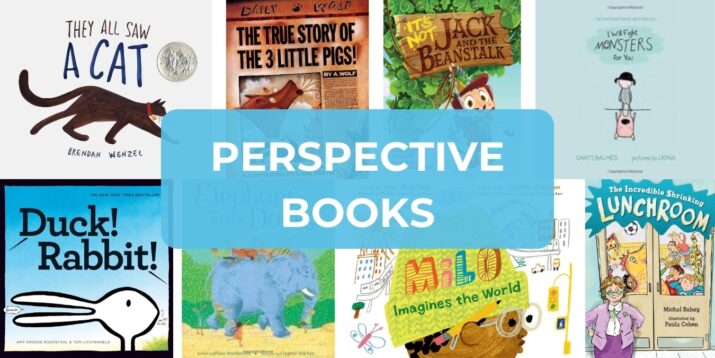

Find your next kids’ book with these children’s book lists and children’s book reviews!

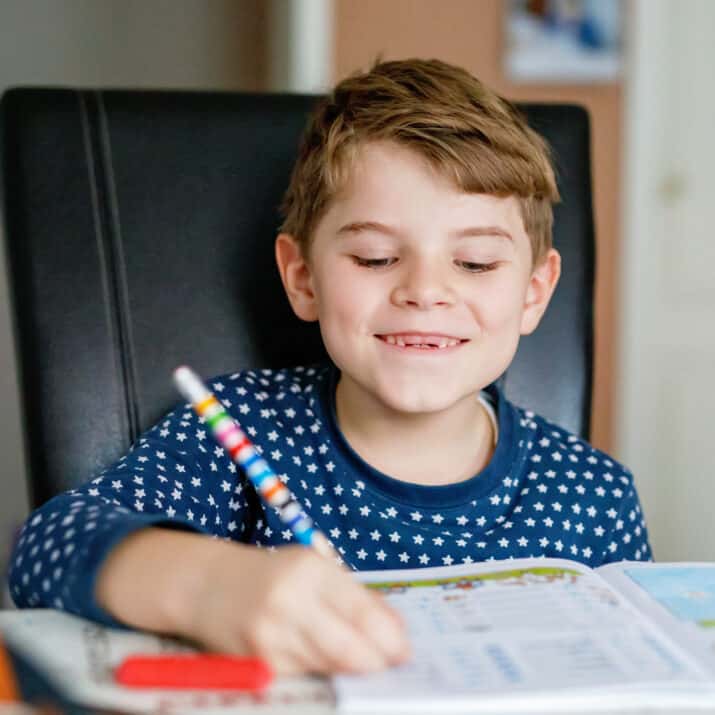

Children’s Books That Hook Kids on Reading

Give children the choice of the best children’s books that will engage them!

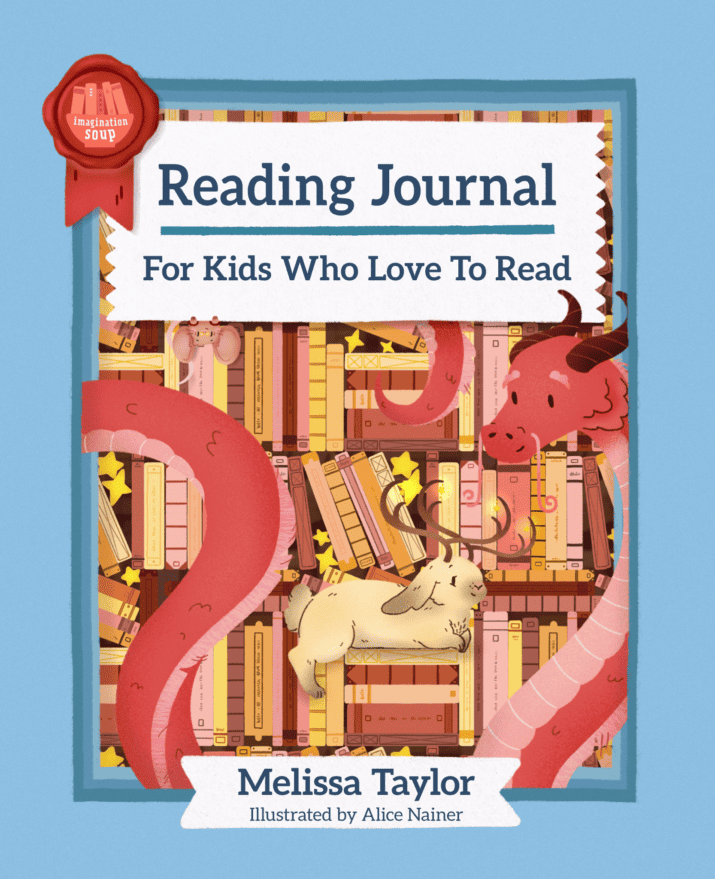

Reading Journal for Kids

102 pages of fun!

Write reviews for books! Draw, imagine, and write more about the books you read. This is a wonderful journal to get kids excited about what they read!

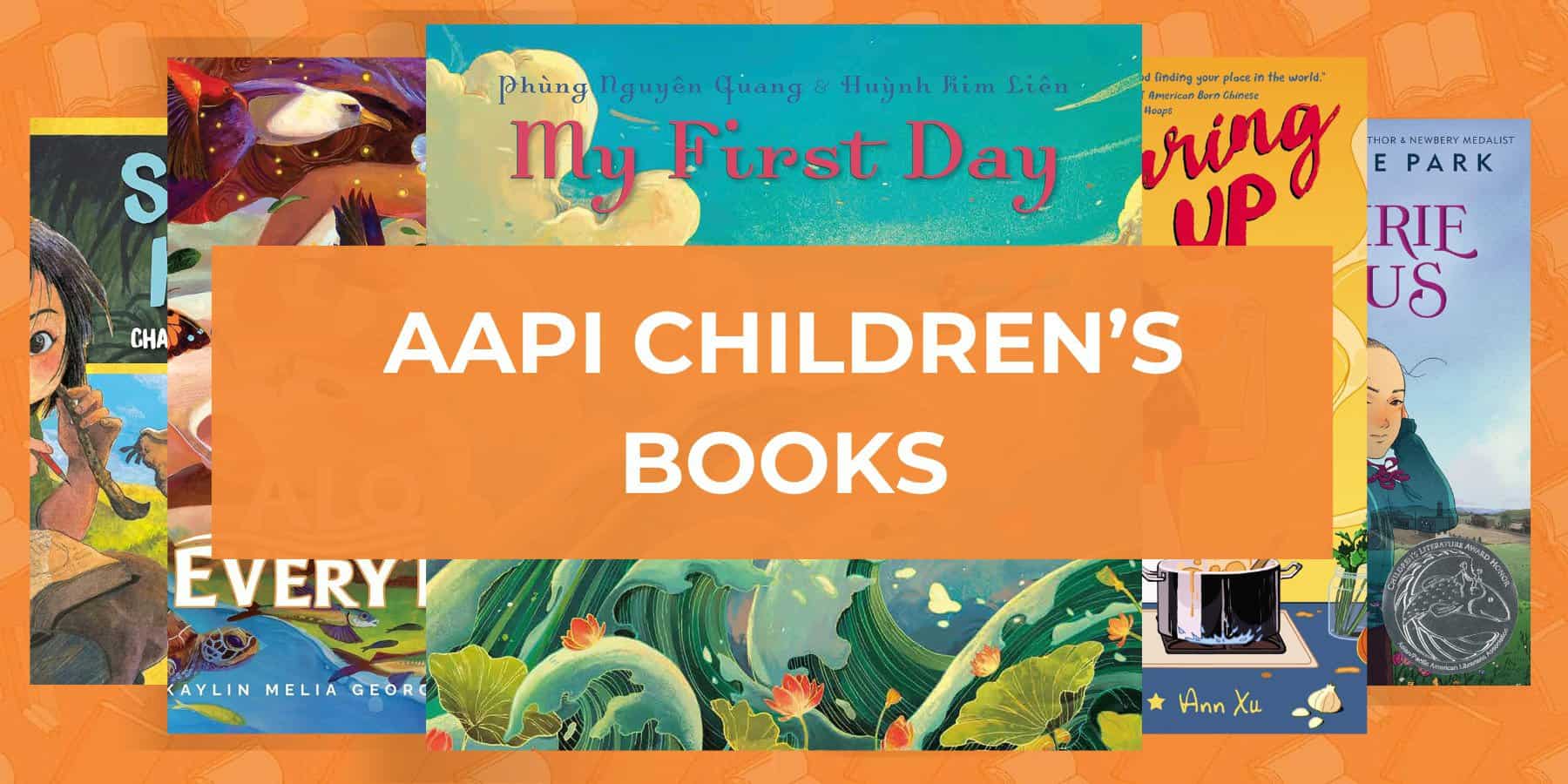

Chapter & Middle Grade Books

WELCOME TO

Imagination Soup

Hi! I’m Melissa Taylor, mom, writer, & former elementary teacher & literacy trainer. I love sharing good children’s books & fun learning resources.

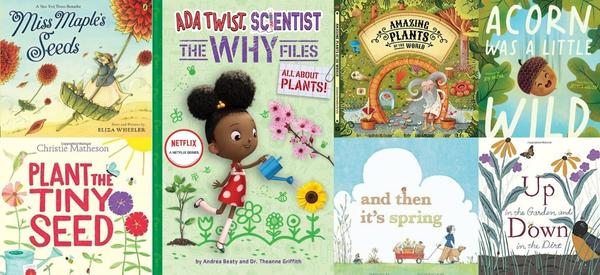

Playful Learning

What is playful learning? It’s learning through play to make learning STICK! Find activities, games, lessons, and more to encourage playful learning in all subject areas, including writing, reading, math, and science.